Using Affordability Safe Harbors to Avoid ACA Penalties

The Affordable Care Act (ACA) requires applicable large employers (ALEs) to offer affordable, minimum-value health coverage to their full-time employees (and dependents) or risk paying a penalty to the IRS. This employer mandate is also known as the “pay-or-play” rules. An ALE is an employer with at least 50 full-time employees, including full-time equivalent employees, during the preceding calendar year.

An ALE’s health coverage is considered affordable if the employee’s required contribution for the lowest-cost self-only coverage that provides minimum value does not exceed 9.5% (as adjusted) of the employee’s household income for the taxable year. For plan years beginning in 2024, the adjusted affordability percentage is 8.39%. The affordability percentage for plan years beginning in 2025 has not been released yet.

Because an employer generally will not know an employee’s household income, the IRS has provided three optional safe harbors that ALEs may use to determine affordability based on information that is available to them: the Form W-2 safe harbor, the rate-of-pay safe harbor and the federal poverty line (FPL) safe harbor.

Affordability Safe Harbors

The IRS has provided three optional safe harbors that ALEs may use to determine their health plan’s affordability:

- Form W-2 safe harbor;

- Rate-of-pay safe harbor; and

- FPL safe harbor.

An ALE may choose to use one or more of the safe harbors for all its employees or for any reasonable category of employees, provided it does so on a uniform and consistent basis.

Adjusted Percentage

The affordability contribution percentage is adjusted each year based on the rates of health coverage premium growth relative to the rates of income growth. The adjusted affordability percentage is:

- 8.39% for plan years beginning in 2024; and

- 9.12% for plan years beginning in 2023.

Safe Harbor Requirements

The safe harbors allow ALEs to determine if their health plan coverage is affordable based on factors other than employees’ household income. ALEs may use the affordability safe harbors if they offer their full-time employees (and dependents) the opportunity to enroll in health plan coverage that provides minimum value. A health plan provides minimum value if it includes substantial coverage of both inpatient hospital services and physician services and covers at least 60% of the total allowed cost of benefits that are expected to be incurred under the plan.

The three affordability safe harbors are all optional. An ALE may choose to use one or more of the safe harbors for all its employees or for any reasonable category of employees, provided it does so on a uniform and consistent basis for all employees in a category. Reasonable categories of employees generally include:

- Specified job categories;

- Nature of compensation (for example, salaried or hourly);

- Geographic location; and

- Similar bona fide business criteria.

A listing of employees by name (or other specific criteria having substantially the same effect) is not considered a reasonable category.

The affordability safe harbors are only used to determine whether an ALE’s coverage satisfies the affordability test under the pay-or-play rules. They do not affect an employee’s eligibility for a premium tax credit for purchasing individual health insurance coverage through an ACA Exchange, which is based on the affordability of employer-sponsored coverage relative to an employee’s household income.

Selecting a Safe Harbor

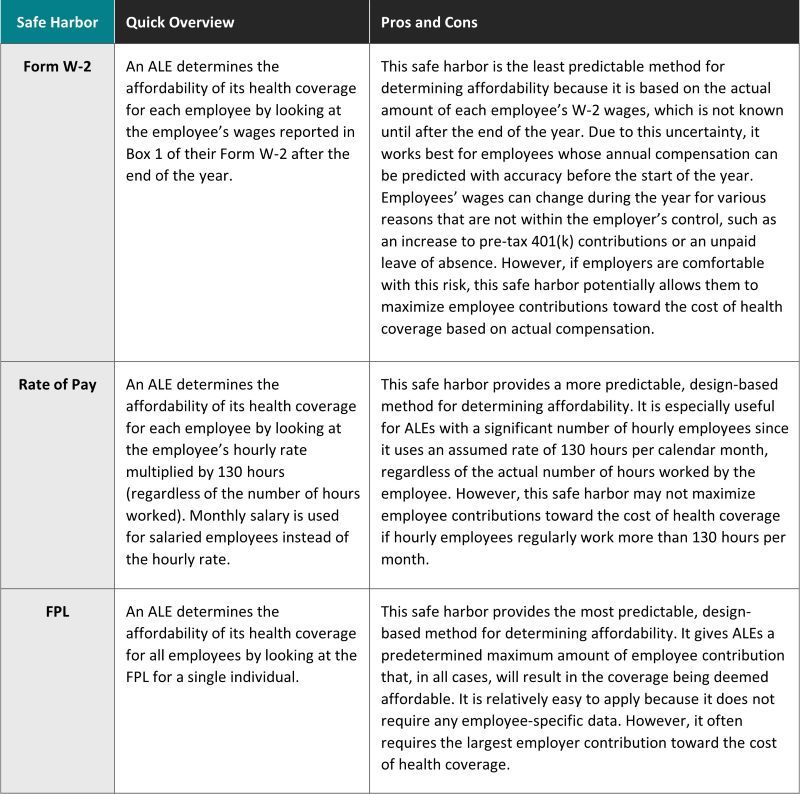

To select a safe harbor for its employees (or for a reasonable category of employees), an ALE should review how each one works. This includes assessing each safe harbor’s level of predictability and ability to maximize employee contributions. Certain safe harbors may be more appropriate than others, depending on an ALE’s workforce.

The following table provides a quick overview of the three affordability safe harbors and identifies the types of employers who may benefit the most from each.

Using The Safe Harbors

Form W-2 Safe Harbor

An ALE using the Form W-2 safe harbor retroactively determines the affordability of its health coverage by looking at each employee’s wages reported in Box 1 of Form W-2. These wages include taxable wages, tips and other compensation paid to the employee for the year, minus any pre-tax benefit deductions.

An ALE’s health coverage is considered affordable under the Form W-2 safe harbor for an employee if the employee’s required contribution for the ALE’s lowest-cost self-only coverage does not exceed 9.5% (as adjusted) of their Form W-2 Box 1 wages for the year.

For example, for an ALE’s health plan to be considered affordable for the plan year beginning in 2024, the maximum monthly premium for an employee with W-2 wages of $60,000 is $419.50. Here is the formula: $60,000 x 8.39% affordability=$5,034] / 12 months=$419.50 maximum per month. The following table shows the maximum contribution amounts for selected W-2 wages for plan years beginning in 2024 and 2025.

Continue Reading this Compliance Advisor to learn more about:

-

Form W-2 Safe Harbor

-

Rate-of-Pay Safe Harbor

-

FPL Safe Harbor

Links and Resources

-

IRS final regulations on the ACA’s pay-or-play rules

-

IRS Revenue Procedure 2023-29, adjusting the affordability percentage for 2024

Prev

Prev