Benefits Easy: Intro to Self-Funding

Benefits Easy: Intro to Self-Funding

Benefits Easy: Intro to Self-Funding

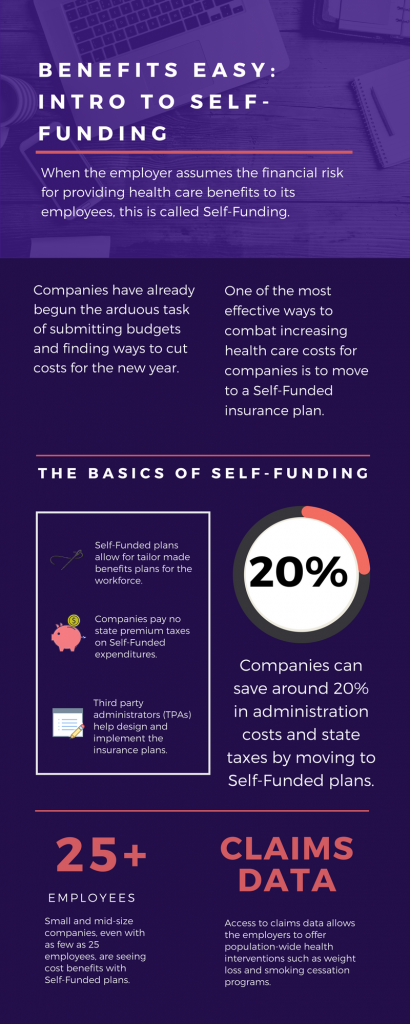

As the first month of 2018 wraps up, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That's quite a cost savings!

The topic of Self-Funding is huge and so we want to break it down into smaller bites for you to digest. This month we want to tackle a basic introduction to Self-Funding and in the coming months, we will cover the benefits, risks, and the stop-loss associated with this type of plan.

THE BASICS

- When the employer assumes the financial risk for providing health care benefits to its employees, this is called Self-Funding.

- Self-Funded plans allow the employer to tailor the benefits plan design to best suit their employees. Employers can look at the demographics of their workforce and decide which benefits would be most utilized as well as cut benefits that are forecasted to be underutilized.

- While previously most used by large companies, small and mid-sized companies, even with as few as 25 employees, are seeing cost benefits to moving to Self-Funded insurance plans.

- Companies pay no state premium taxes on self-funded expenditures. This savings is around 5% - 3/5% depending on in which state the company operates.

- Since employers are paying for claims, they have access to claims data. While keeping within HIPAA privacy guidelines, the employer can identify and reach out to employees with certain at-risk conditions (diabetes, heart disease, stroke) and offer assistance with combating these health concerns. This also allows greater population-wide health intervention like weight loss programs and smoking cessation assistance.

- Companies typically hire third-party administrators (TPA) to help design and administer the insurance plans. This allows greater control of the plan benefits and claims payments for the company.

As you can see, Self-Funding has many facets. It's important to gather as much information as you can and weigh the benefits and risks of moving from a Fully-Funded plan for your company to a Self-Funded one. Doing your research and making the move to a Self-Funded plan could help you gain greater control over your healthcare costs and allow you to design an original plan that best fits your employees.

Prev

Prev