2025 Penalties for Health & Welfare Plans

Posted:

in

Penalties

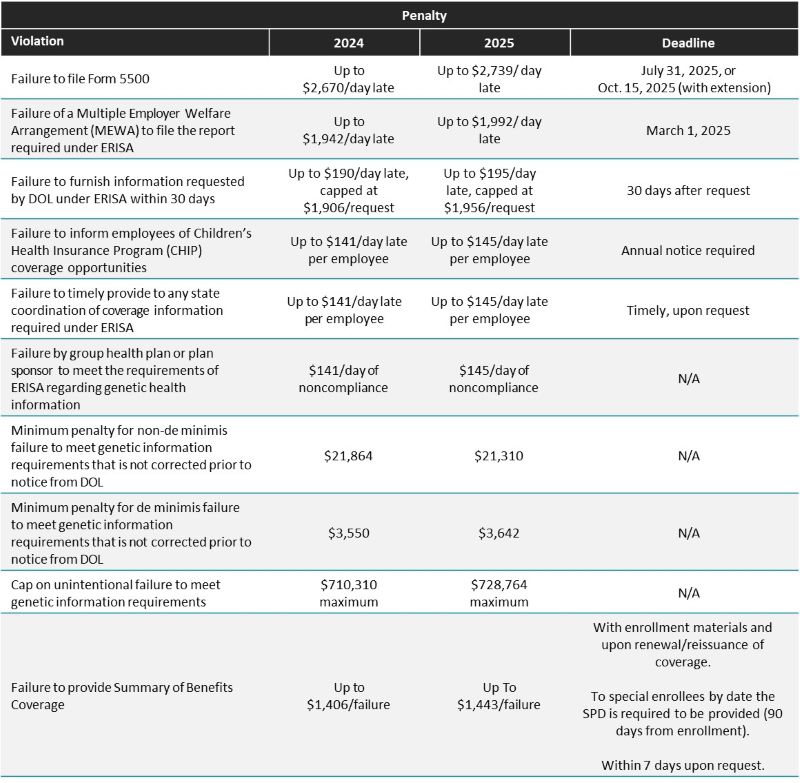

In January, the Department of Labor (DOL) published the inflation-adjusted penalties for ERISA violations in 2025. The following table summarizes the new penalty amounts and reminds employers of filing deadlines to avoid incurring penalties.

Employer Action Items

- Prepare for annual filing or extension to file Form 5500 by July 31 for calendar year plans.

- Ensure annual notices have been distributed and are on track to be distributed for the next plan year.

- Conduct an internal compliance audit to ensure compliance with the prohibition of discrimination based on genetic health information.

- Be prepared to respond to requests for information from the DOL or state agencies.

Contact a SSG Benefits Advisor if you have further questions.

SOURCE: United Benefit Advisors (UBA and Fisher Phillips, Atlanta

Prev

Prev